This article is to give you a brief about the TDS (Tax Deducted at Source) process. TDS is applicable on Instamojo fees in the below scenarios:

- If the fees charged on you are greater than Rs. 15,000 in a financial year.

How to pay TDS?

To pay the TDS, follow the below steps:

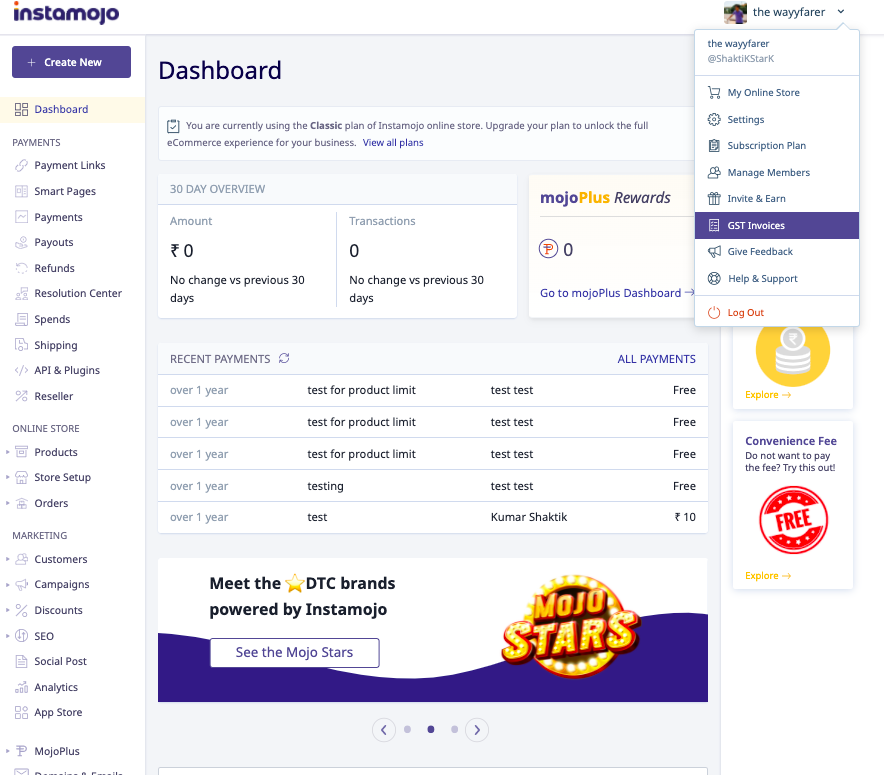

- Download the invoice from your Instamojo Dashboard - simply log in to your dashboard and click on your profile name.

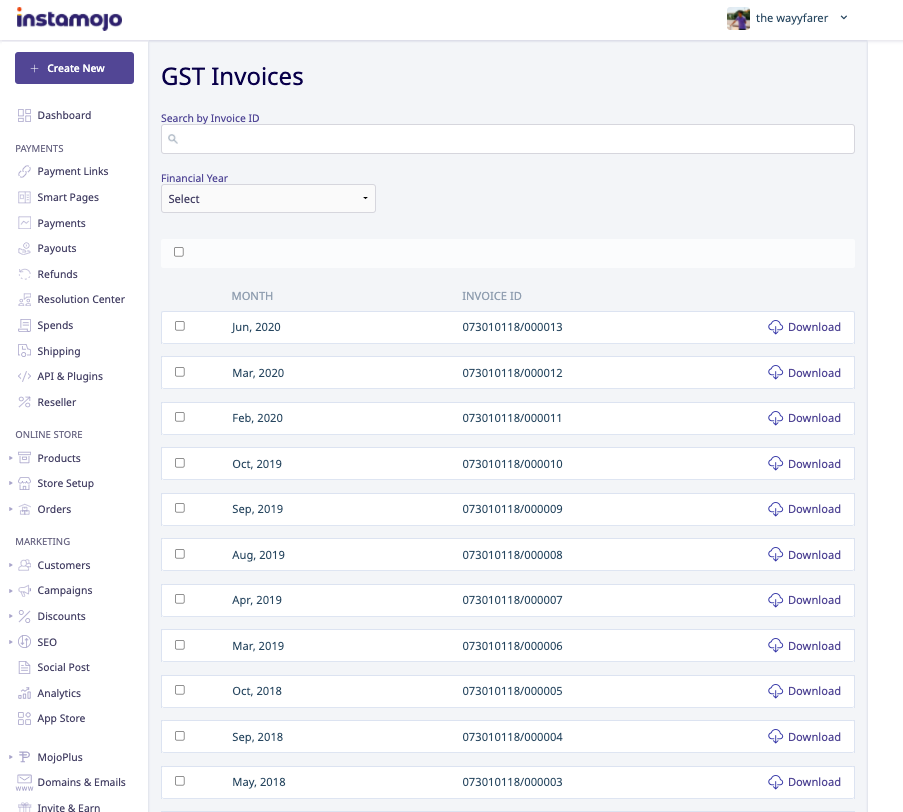

- From the dropdown menu, select GST Invoices. Note that the GST invoices are published here at the beginning of every next month.

- Based on the invoice, deposit TDS on behalf of Instamojo Research and Development Pvt. Ltd(Refer here for TDS payments: TDS payment).

- Email the digitally signed certificate for deposited TDS (Form 16A) to support@instamojo.com, along with the below details:

-

Your registered email address and username

-

Your legal entity name

-

Name as on bank account

-

Bank account number

-

IFSC code

-

- Post receipt of the certificate, Instamojo will reimburse the TDS amount. It can take up to 15 days to process the payment.

Notes:

- When it comes to Income Tax Section codes, for all commission-related bills, the tax will be deducted as per Section Code 194 H only (Commission or Brokerage).

- Instamojo is not liable for any extra amount deposited by the merchant (you). It is advisable that the TDS is deposited as per the invoice (without taxes).