What is Virtual Payment Address?

VPA is a unique identifier that is mapped with an individual bank account. UPI enables bank account holders (of banks participating in UPI) to send and receive money using a Virtual Payment Address (VPA) without entering additional bank information.

How can I set a VPA?

Download the UPI app from your bank. In fact, you can download any bank’s UPI app, it need not be your own bank. All that is needed is for your bank to be UPI enabled. Currently, 155 banks in India are a part of UPI including major ones like ICICI Bank, Axis Bank, Yes Bank, HBSC.

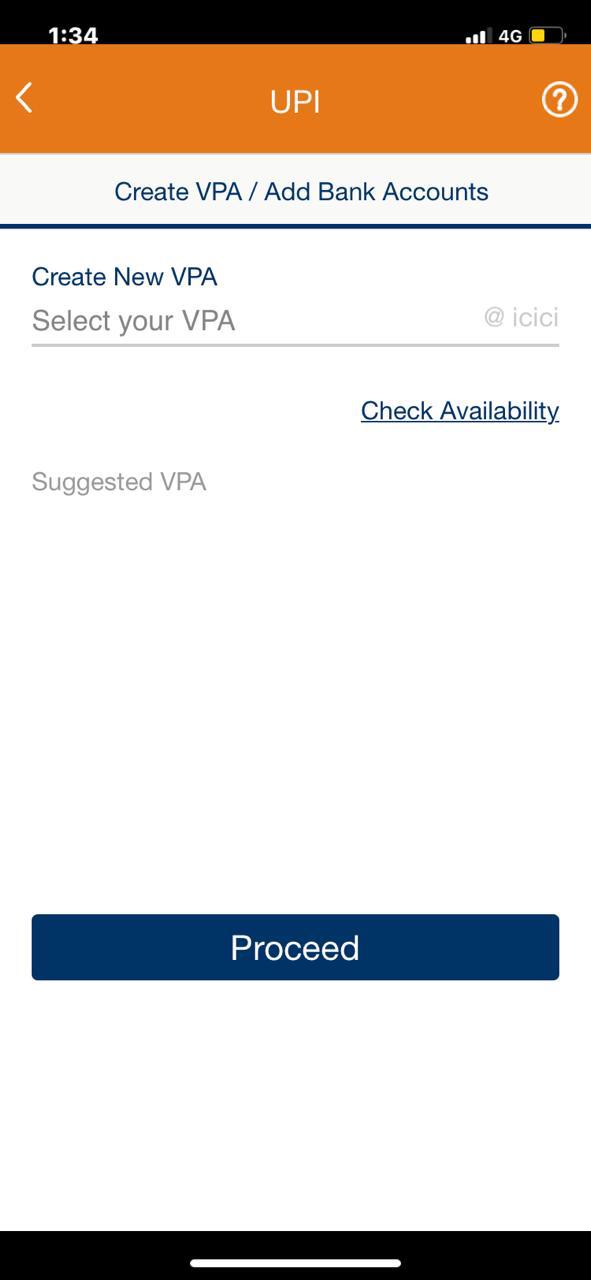

A VPA looks like abc@icici. You can check for the availability and create one as you desire. This VPA links to your bank account. As mentioned above, a VPA like example@icici can be linked to an Axis Bank account, and vice versa.

Keep the app installed on your phone. You will need it every time you have to make a UPI transaction.

Below given is an example of how to create VPA in the ICICI bank app. Note that the UI will be different depending on the app.

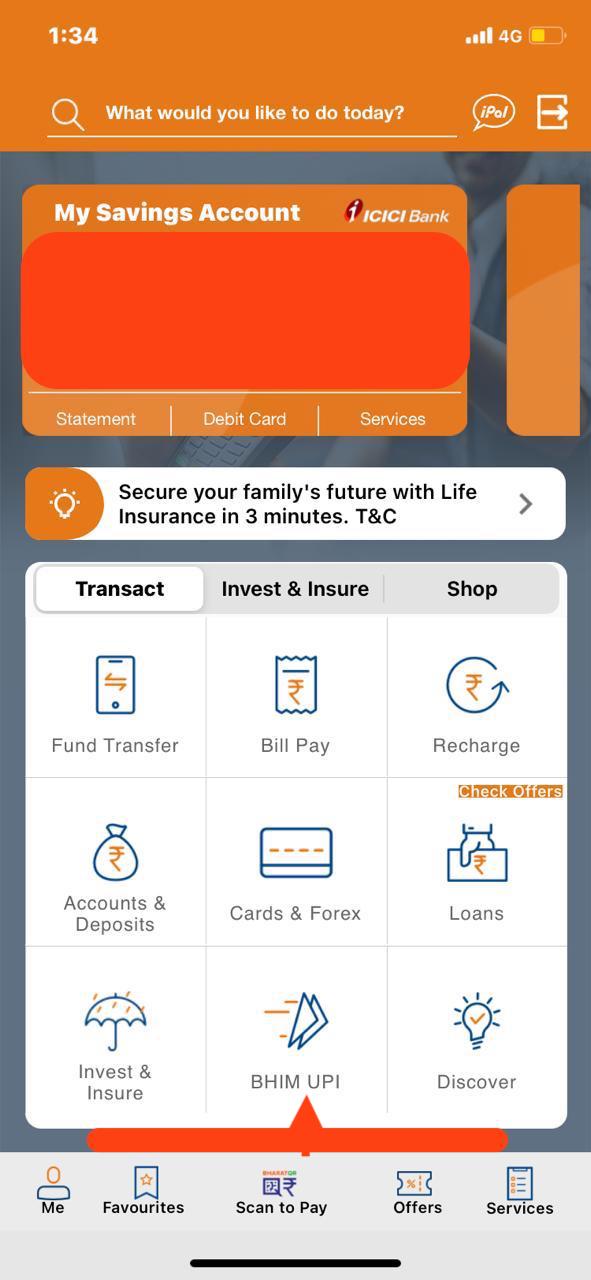

1. Log in to the bank app and click on BHIM UPI:

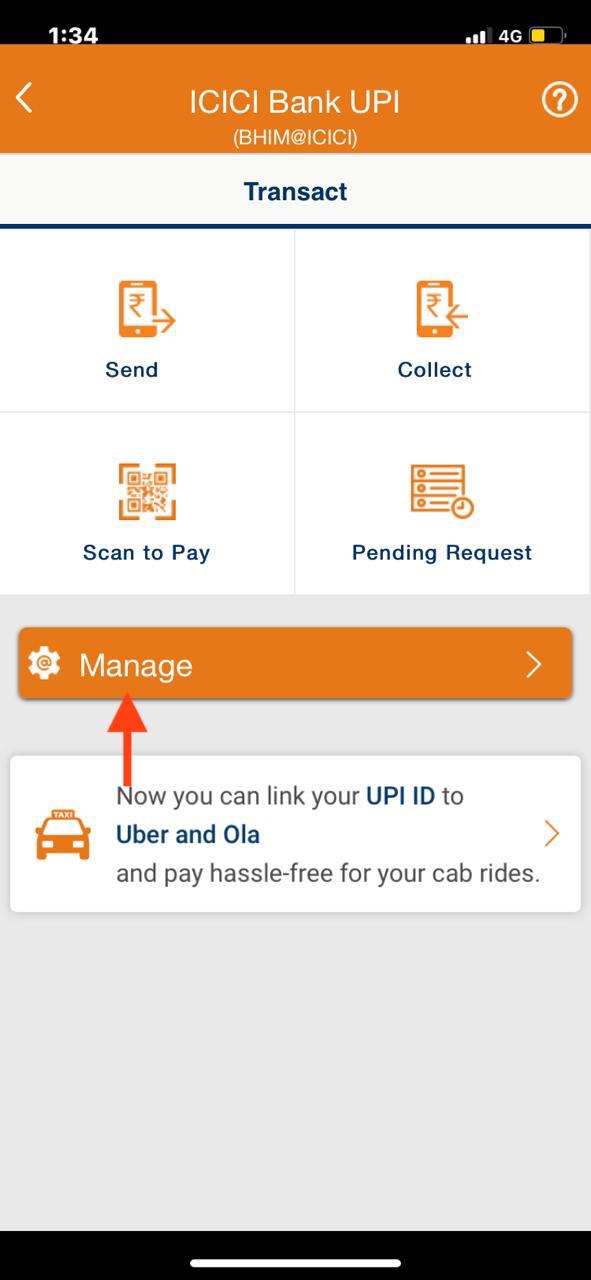

2. On the next page, click on Manage:

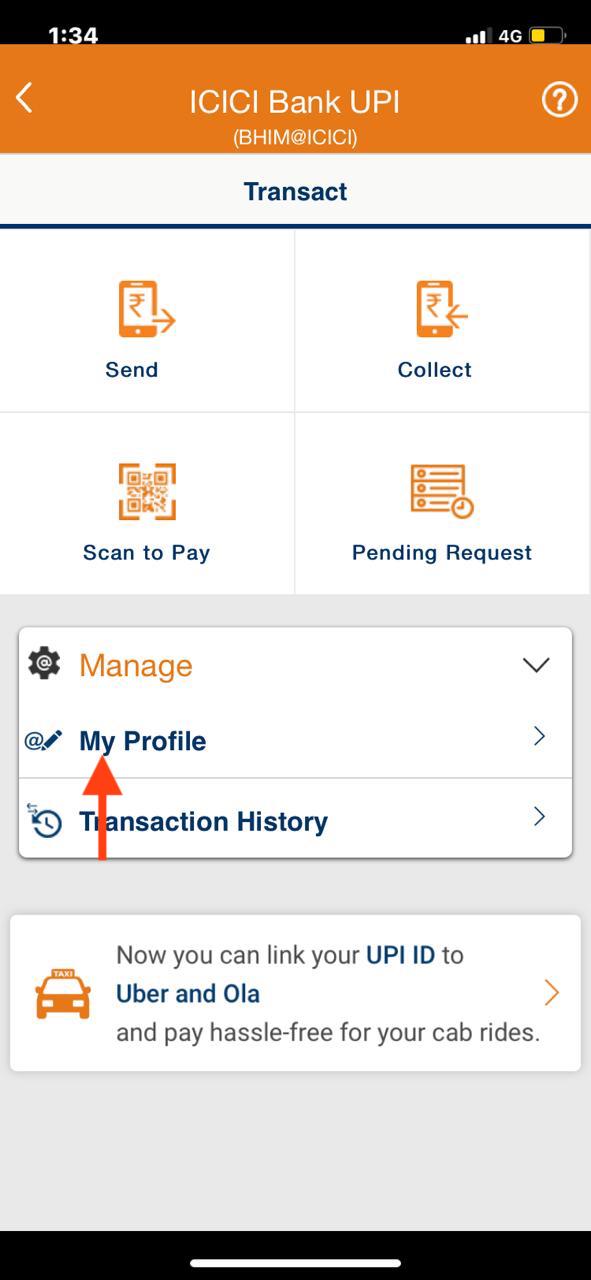

3. Next, click on My Profile:

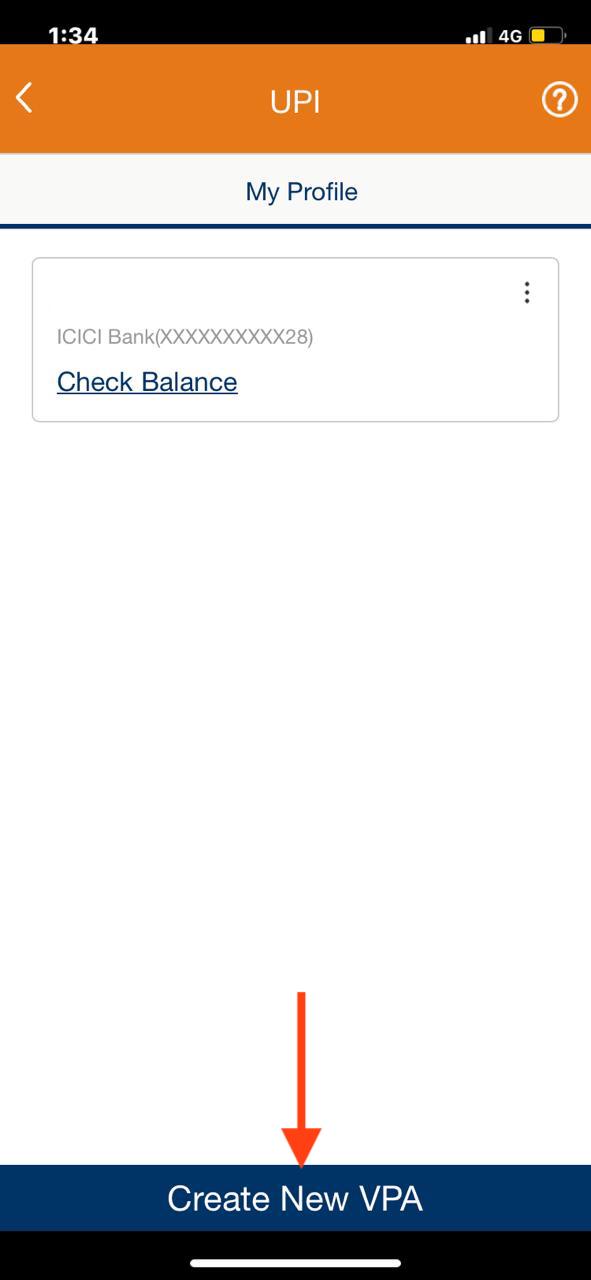

4. On the next page, click on Create VPA and this will lead you to the page where you can enter the details and create your own VPN:

I hope this was helpful folks! Do let us know your feedback on our articles. You can enter your comments below or drop us a mail at support@instamojo.com.

Read more on VPA blogs on Instamojo.